The success of shale gas in the US has prompted companies to examine the possibilities of replicating the shale gas production and market in Europe. But in doing so they face various difficulties including issues such as the different geology, the density of European population, the legal, fiscal and land-use particularities and the service industry for onshore. To add to the difficulties, there is considerable environmental skepticism and opposition from lobby groups and media regarding shale gas drilling in Europe. Hence, a comprehensive assessment of risks of shale gas development in Europe is helpful to prevent harms as well as to take into consideration investment and growth opportunities. In this paper we outline six major clusters of risks associated with developing the shale gas industry in Europe: social, environmental, economic, regulatory, geopolitical, and technological by forming a PESTLE analysis. The outcome of this paper is extremely useful to companies’ leaders willing to invest in shale gas in some European countries. This dimension of contemplating the risks associated with shale gas development, from the companies’ point of view, has received less attention so far and provides opportunities for further research, particularly from management scholars.

I. INTRODUCTION

The “Shale gas revolution” refers to a phenomenon that emerges from the growth of domestic unconventional gas supply in North America. According to the U.S. Energy Information Administration (Annual Energy Outlook, 2011), estimates of the recoverable gas resources from U.S. shale gas plays have more than doubled between 2010 and 2011. Shale gas will likely remain a growing part of the energy landscape in North America (Boersma and Johnson, 2012). With a shift from a declining gas producer to a growing producer, it is forecasted that nearly half of the US natural gas will come from shale gas by 2035 (Rahm, 2011). The success of shale gas in the US has prompted geologists in a number of European countries to examine the productive possibilities of their own shale resources and several European countries have indeed launched reviews in advance of possible future exploration decisions. There are significant shale gas reserves in Europe, with technically recoverable shale gas resources estimated at approximately 18 trillion cubic metres (m3) (EIA, 2011). However, exploitation of shale gas to date has been limited and there is no commercial production at present (AEA, 2012a). This is because there are unique challenges for companies seeking to invest in shale gas development in Europe (Boersma and Johnson, 2012). The geology is less favourable to shale exploration. There is greater population density in much of Europe compared to the US. Moreover, legal issues, fiscal realities, land use particularities, cultural approaches, environmental and energy priorities, and the lack of an experienced service industry for unconventional drilling add to the challenges (Steven, 2010). Further adding to the mix is the considerable environmental skepticism and opposition across Europe regarding shale gas drilling – and this opposition was further influenced by the widespread European viewership of the documentary film “Gasland.” (Rham, 2011). Key questions remain unanswered, for we do not yet know with any degree of clarity what shale gas will cost to produce nor have commercially viable amounts of shale gas been extracted in Europe.

The structure of the paper is as follows. Firstly, we explain our research methodology and conclude on how we built our major six risk clusters, with their implications for shale gas industry development in Europe. Second, we use elements of risk from each of the six clusters to assess in greater detail each of strategic risks associated with shale gas development in a sampling of three European countries: United Kingdom, France and Poland. We conclude with considerations for the shale gas industry and individual companies to consider regarding European shale gas industry.

II. METHODOLOGY AND DATA

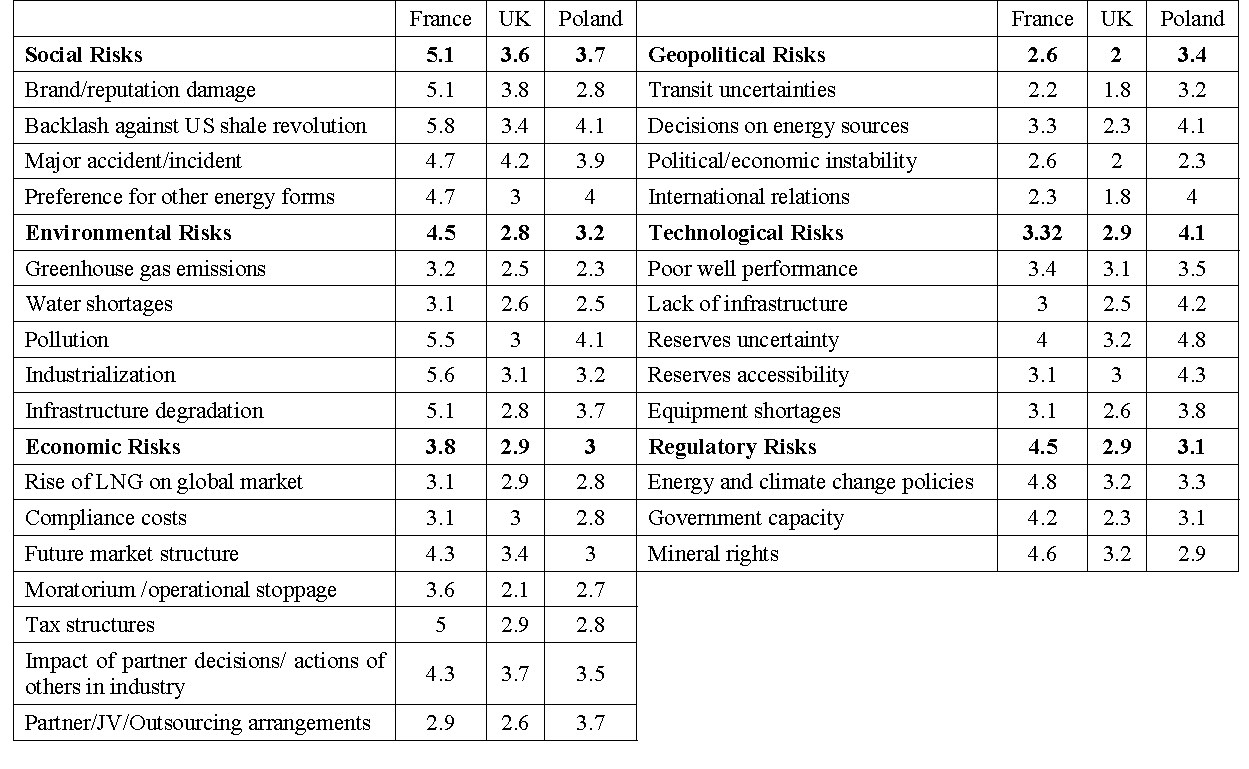

Our research was supported by intense desk research, participation in six unconventional gas conferences and twenty-six extensive discussions and semi-conducted interviews, followed by a structured questionnaire online with the same experts from various companies and institutions in the oil and gas industry. We conducted our interviews from March 2012 to December 2012. The first round consisted of broad open questions to participants according to their field of expertise. During this phase we also developed the 6 major clusters of risks, which we then shared with academics and practitioners for their insights and recommended refinements. Interview is the primarily means of data-gathering as it represents one of the most appropriate methods to study perception. This method has the advantage of being able to obtain immediate clarification as well as gaining knowledge of subjective, but deeply felt, human experiences (Mintzberg, 1973). In-depth information from a small number of people can be very valuable, especially if the cases are information- rich (Platton, 1990). Robson (2002) states that a grounded theory study needs between 20 and 30 participants involved in the study. Using a modified form of PESTEL analysis, with the guidance of the experts from the interviews, we firstly outlined six major clusters of risks associated with developing the shale gas industry in Europe: social, environmental, economic, regulatory, geopolitical, and technological (table 2 and Fig.1). Through a structured close question questionnaire from September 2012 to January 2013, we then asked the same experts to answer key questions previously developed on the 6 clusters, specifically to country assessment. All were focused and standard set of questions from the study protocol so as to collect data in a consistent manner (table 2). Bearing in mind that legislation and regulatory regimes related to hydraulic fracturing and unconventional gas E&P activities are in flux in Europe, which influences trends towards shale gas development, the cross-analysis of the desk research and interviews allowed us to catalog the risks associated with shale gas development in Europe, and assess them for 3 European countries.

| Date | Country | Interview with |

| March, 2012 | UK | Non-executive Direct or of an energy company |

| April, 2012 | France | Head of the Petroleum Economics and Management Programme |

| April, 2012 | France | Senior Petroleum Negotiator |

| April, 2012 | France and UK | Chief Financial Officer of an Oil & Gas company |

| April, 2012 | US | Managing Partner and Founder of an Unconventional Energy Company |

| April, 2012 | US | Professor of Geoscience |

| April, 2012 | UK | Vice president, Commodities Research in a bank |

| April, 2012 | UK | Senior Research Fellow in a major UK Research Institution |

| May, 2012 | UK | Senior Consult ant in Energy |

| May, 2012 | UK | Non-executive Direct or of an energy company |

| May, 2012 | France | Gas, Oil and Coal Economics Analyst |

| May, 2012 | UK | Analyst , Central Eastern Europe, in a Risk Management Consulting Company |

| May, 2012 | Australia | Direct or of Corporate Communication in a Oil & Gas Company |

| May, 2012 | Brussels | Policy Officer at the European Commission |

| June, 2012 | US | Executive Vice President and General Council of an Oil & Gas Company |

| June, 2012 | US | Direct or of a Consulting Company in Energy |

| July, 2012 | US | Senior Research Analyst in an Energy Business Intelligence |

| Sept ember, 2012 | UK | Senior Associate at a Consulting Group |

| Sept ember, 2012 | Poland | Gas expert in a Energy Inst it ut ion |

| November, 2012 | France and UK | Professor and Direct or of a Research Cent re in Energy |

| November, 2012 | France | Senior Research Analyst in Gas in a Bank |

| December, 2012 | UK | Direct or at a Research Cent re in Energy |

| December, 2012 | UK | Professor in Oil & Gas and Finance |

| December, 2012 | UK | Direct or and Founder of a Research Cent re in Energy |

| December, 2012 | UK | Visiting Professor, Department of Economics and International Studies |

| December, 2012 | Bulgaria | Professor, Department of Environment al Sciences and Policy |

III. FINDINGS FROM THE INTERVIEWS AND THE QUESTIONNAIRE

Using the six clusters, we assessed risk levels associated with investing in shale development in three particular countries from the questionnaires: France, the UK and Poland. Each of these three countries exhibits strong potential for shale gas development and varying degrees of risks. France has significant reserves of shale gas but the current ban has stopped shale gas development in its tracks. The UK has a supportive hydrocarbon culture and strong hydrocarbon regulatory protocols, but endures the backlash of hydraulic fracturing- caused seismic disturbances. Finally, Poland may possess appreciable shale gas reserves, are supportive of shale gas development and they seek to cut Russian natural gas imports, but there is still significant political, tax, regulatory and business uncertainty for investors to consider. For each of the cluster and sub-cluster, we asked the respondents to answer “1” when they perceived low risks and “6” when they perceived very high risks for shale gas development in 3 countries. Our assessment is by no means exhaustive; rather, it provides a current evaluation illustrating key differences and similarities between countries at different stages of shale gas development.

Table 2: PESTLE analysis of the Shale Gas industry in Europe

A. France

The US Energy Information Administration (2011) estimates that France has 5.1 trillion cubic meters (tcm) of shale gas reserves. On June 30th 2011, France became the first country in Europe to impose a ban on hydraulic fracturing. At the time, 64 exploration licenses had been issued, many for the Paris Basin with its large shale deposits. Of 64 licenses held, holders of 61 licenses agreed that they would not explore using hydraulic fracturing; in October, the French government revoked the remaining three licenses, one for Total and two for Schuepbach Energy.

Social Risks (5.1/6) are very high in France. There is considerable organized opposition to shale gas development at all levels of society and within the government and various political parties. What is unclear, however, is the depth of opposition across the country writ large. Historically France possesses a preference for nuclear power generation.

Environmental Risks (4.5/6): There is a high degree of urbanization, particularly in the Paris Basin. There are strong perceptions of environmental and safety hazards associated with hydraulic fracturing.

Economics Risks (3.8/6): The ban imposed on shale gas activities remains in place and until it is overturned, economic risks will remain high.

Geopolitics Risks (2.6/6): France currently imports 98% of its natural gas.

Technological Risks (3.32/6): The government’s ban currently limits extraction to vertical drilling/no hydraulic fracturing; however, French companies are acquiring appropriate skills and experience outside France through JV/partnering.

Regulatory Risks (4.5/6): There is no support so far from the French government. It is uncertain which direction the new government will take regarding shale gas development, based on its actions the first year in office.

B. United Kingdom

The British Geological Survey (BGS) (2011) estimates that the UK has 150 bcm of shale gas reserves, though a much- needed, more definitive survey is planned to obtain more precise figures. Subsequent to the release of BGS estimates, Cuadrilla Resources announced shale gas estimates of 5.7 tcm at its sites in northwest England, and IGas doubled estimates of reserves contained at its site in northwest England to 130 bcm.

Social Risks (3.6/6): Though there is considerable vocal opposition to shale gas development, the UK’s strong hydrocarbon economy will likely prevail over opponents’ concerns. There is a medium level of public resistance.

Environmental Risks (2.8/6): Resiliency to serious shale incidents outside the UK. Concerns with earthquakes/ environmental damage have increased over the past year, but likely will not prevent shale gas development; measures to mitigate concerns with seismic activity have already been introduced. Royal Society and Royal Academy of Engineering review concluded that fracking can be effectively managed.

Economics Risks (2.9/6): Looking at LNG prices paid in the EU, it can be observed that in the UK, LNG imports continue to be attractively priced to hub traded gas and generally, natural gas demands are increasing.

Geopolitics Risks (2/6): There is a need to diversify energy sources and enhance energy security; LNG imports have been increasing, with nearly all LNG coming from Qatar.

Technological Risks (2.9/6): the UK has experienced natural gas extraction workforce (albeit mostly related to North Sea production and conventional onshore drilling). The UK has a strong gas/oil partnering experience levels.

Regulatory Risks (2.9/6): A strong hydrocarbon culture and regulatory framework exists. The Government recently approved hydraulic fracturing in the UK.

C. Poland

Poland represents the most aggressive environment in Europe for the development of shale gas, due to the government’s strong aim to reduce its dependence on Russian gas. Prime Minister Donald Tusk has indicated that shale gas commercial production could begin in 2014. He also expects Poland to be self-sufficient in natural gas by 2035. Nearly 20 companies involved in the shale gas sector, both national and international, are currently operating in Poland; they altogether hold 110 exploration licenses (after last year’s Exxon Mobil withdrawal), primarily for shale gas but also for tight gas. Poland’s PGNiG has 15 licenses.

Although the US Energy Information Administration in 2011 estimated Poland’s reserves at 5.3 tcm, enough to meet its energy demand for three centuries, the Polish Geological Institute (2012) recently reduced this estimation to 346 bcm to 768 bcm, which represents 36 to 65 years of cumulative consumption in the Polish market.

Social Risks (3.7/6): The public, if not supportive, does not appear strongly opposed to shale gas development. There is a high level of public resiliency to serious shale incidents outside Poland.

The Environmental Risks (3.2/6) concerns are primarily related to Polish Government’s desire to hasten development and emphasize local industry, perhaps even at the expense of partnering with experienced non-Polish companies (European Parliament, 2012a).

Economics Risks (3/6) are related to uncertainty over tax structure decisions. Growing pressures from some political parties for less foreign involvement and greater indigenous shale gas activities. Companies holding licenses in Poland to explore for shale gas extraction are generally moving ahead despite Exxon Mobile’s recent decision to exit from shale gas exploration efforts in Poland.

Geopolitics Risks (3.4/6): Energy diversification has long been an issue of strategic importance for the Polish government, which wants to cut its dependence on imports of oil and gas from Russia. We perceive some significant.

Technological Risks (4.1/6) since Poland lacks appropriate experience levels; relationships with foreign companies is very much needed in order to improve Polish technological skills and know-how. There is an uneven transportation and pipeline development across country; some regions (East) have poorly developed infrastructure.

Regulatory Risks (3.1/6): Regulation formulation for extracting shale gas is in progress. There is a heavy bureaucracy, opaque and discretionary licensing regime. Support from government creates a propitious climate for investors.

IV. CONCLUSION

Much of the discussion to date on European shale gas development has been steered by events occurring across the Atlantic in North America, particularly by events where industry did not employ “best practices.” And many of these discussions have been informed largely by emotion and hype rather than by a structured risk assessment. But companies must understand that shale gas development represents both risk and opportunities and that they must assess them in order to make appropriate decisions on (1) whether or not to enter into the European shale game, and (2) if they do enter onto the field, the risks that are of the greatest consequence to executing their business strategies.

This study examined the most consequential risks for companies contemplating entry into the European shale gas market and identified six clusters of strategic risks: social, environmental, economic, regulatory, geopolitical, and technological. According to the experts we interviewed, social risks often pose the greatest threat to shale gas development in Europe. How the public perceives the impact of shale gas development on their welfare or their environment is the most important factor in addressing social risks. Therefore, companies should not discount the potential risks posed by social media or the need to anticipate opposition efforts to influence and expand their own stakeholder base. There are clear future opportunities if proactive measures are taken today to counter misperceptions and to address social and environmental impacts. Similarly, anticipating and addressing emerging and longer-term regulatory risks can create future market opportunities and competitive advantages. The regulatory landscape reflects the uneven acceptance for shale

E&P across Europe. Countries have different regulatory emphases and levels of regulatory maturity governing hydrocarbon extraction. Greater creative tension can be expected between operators and regulators than in the US, and permitting processes are likely to take longer than in the US.

The shale gas landscape in Europe continues to evolve, and much of its dynamism results from changing national policies. As our cursory assessment of three countries demonstrated, there are significant differences in risk levels between countries, and many of these differences are generally attributable to environmental and energy priorities as well as national cultural approaches. Numerous reviews are currently underway which will likely influence policy changes in several countries over the next 18 months; thus, we can anticipate continued volatility across the shale gas landscape in Europe.

Source: Roux Lucie, Jim Seaton, Patrick Gougeon và Kostas Andriosopoulo (2013), “Risk Assessment for the Shale Gas industry in Europe”, Research Centre for Energy Management, ESCP Europe Business School, London, United Kingdom.

V. REFERENCES

AEA, 2012a. Climate Impact of Potential Shale Gas Production in the EU. European Commission DG Clima, Brussels.

Boersma, T. and Johnson, C., 2012. The Shale Gas Revolution: US and EU Policy and Research Agendas. Review of Policy Research 29, 570-576.

British Geological Survey (2011). The Unconventional Hydrocarbon Resources of Britains’s Onshore Basins – Shale Gas. Available at: http://og.decc.gov.uk/assets/og/bo/onshore-paper/UK-onshore-shalegas.pdf

Butler, S and Kiss, B. (2012). Central and Eastern European Shale Gas Outlook. Available at: http://www.kpmg.com/LT/lt/IssuesAndInsights/ArticlesPublications/Document s/Central%20and%20Eastern%20Europe%20Shale%20Gas%20Outlook.pdf

DiPaola, A. (2013). Shale-Gas Boom can Complement Renewables to Cut Coal, IRENA says. Bloomberg. Available at: http://www.bloomberg.com/news/2013-01-10/shale-gas-boom-can-complement-renewables-to-cut-coal-irena-says.html

EIA (Energy Information Administration). (2011). World Shale Gas Resources: An Initial Assessment of 14 Regions Outside the United States. Available at: http://www.eia.gov/analysis/studies/worldshalegas/.

EIA (Energy Information Administration), (2012). Annual Energy Outlook. Overview US Department of Energy. Available at: http://www.eia.gov/forecasts/aeo/pdf/0383(2012).pdf

Enggelder, T. (2011). Natural Gas: should fracking stop? Counterpoint. No, it’s too valuable. Nature 477 (7364), 271-275.

European Parliament (2012a). Draft Report on the Environmental Impacts of Shale Gas and Shale Oil Extraction Activities, Committee on the Environment, Public Health and Food Safety, Luxembourg

IEA (International Energy Agency) (2012). Golden Rules for a Golden Age of Gas, May. Paris: OECD. Available at: http://www.worldenergyoutlook.org/media/weowebsite/2012/goldenrules/WE O2012_GoldenRulesReport.pdf

Mintzberg, H. (1973). The Nature of Managerial Work, New York: Harper & Row

Moniz, E., Jacoby, H. Meggs, A., (2011). The Future of Natural Gas. Technical Report. MIT Energy Initiative (MITEI)

European Parliament (2012a). Draft Report on the Environmental Impacts of Shale Gas and Shale Oil Extraction Activities, Committee on the Environment, Public Health and Food Safety, Luxembourg.

Gény, F. (2010). Can Unconventional Gas be a Game Changer in European Gas Markets?. The Oxford Institute for Energy Studies, NG 46, December.

Pearson, I., Zeniewski, P. Gracceva, F. Zastera, P. McGlade, C., Sorrell, S., Speirs, J., Thonhauser, G., Alecu, C., Eriksoon, A., Toft, P., Schuetz, M.

(2012). Unconventional Gas: Potential Energy Market Impacts in the European Union, JRC Scientific and Policy Reports. European Commission, Brussels.

Platton, M. (1990). Qualitative Evaluation And Research Methods, 2nd ed., Sage Publications, London

Polish Geological Institute (2012). First Report on Shale Gas and Shale Oil: Press Conference.(March 22) Available at: http://www.pgi.gov.pl/en/archiwum-aktualnosci-instytutu/4112-pierwszy-raport-o-zasobach-gazu-i-ropy-w-upkach-konferencja-prasowa.html, accessed June 28.

Punch, K., (1998). Introduction to Social Research: Quantitative and Qualitative Approaches. Sage Publishers, London

Rahm, D. (2011). Regulating hydraulic fracturing in shale gas plays: the case of Texas. Energy Policy Journal, 39, 2974-2981. Retrieved from: http://www.sciencedirect.com/science/article/pii/S0301421511001893.

Robson, C. (2002). Real World Research, 2nd ed. Blackwell

Rogers, H. V. (2012). The Impact of a Globalising Market of Future European Gas Supply and Pricing: the Importance of Asian Demand and North American Supply. Oxford Institute for Energy Studies, NG 59, January.

Stevens, P. ( 2010). The ‘Shale Gas Revolution’: hype and Reality. Chatham House Report. London: Chatham House.

16 Jul 2020

26 Mar 2023

1 May 2020

9 Sep 2019

19 Sep 2021

16 Jul 2020