Most entrepreneurs dream of an innovative product or service that surprises their rivals and takes new markets by storm. What they tend to forget is that there needs to be an excellent business strategy accompanying the product.

From Tesla, Airbnb, and Toyota to Hubspot, Apple, and Paypal – let’s dive into their business strategies and see why these 7 are the best ones we have ever seen:

- Tesla – Playing the long game

- Airbnb – Forgetting all about scalability

- Toyota – Humility can be the best business strategy

- HubSpot – Creating an industry then dominating it

- Apple – iPhone launch shows tremendous restraint

- PayPal – Daring to challenge the status quo

- Spotify – Changing the rules of the music industry

1. Tesla – Playing the long game

Conventional business logic is that when you’re starting something new, you create a ‘Minimal Viable Product’ or MVP.

Essentially that means that you make a version of your product that is very light in terms of functionality and focuses mostly on showcasing your main competitive advantage.

It also means that the first version of your product usually has to be sold at a reasonably low starting price to compensate for its lack of features and generate interest.

Some organizations (including many tech startups) take this concept even further and base their growth strategy around a freemium pricing model. In this business model, the most basic version of the product or service is free, but any new or upgraded features cost money.

Tesla, on the other hand, did things the other way around. It’s been known for a long time that Tesla’s long-term goal is to be the biggest car company in the world. They know that in order to become the biggest by volume, they’re going to have to succeed in the lower-end consumer car space (price tag US$30,000 or less).

But Tesla did not focus on this market first. It did not create a cheap low-featured version of their electric car (and therefore benefit from economies of scale).

Instead, Tesla created the most luxurious, expensive, fully-featured sports car they could afford. That car was the Tesla Roadster, and for context, the newest generation of the Roadster will retail from upwards of US$200,000 for the base model.

This was the first car they ever produced – knowing that they couldn’t achieve the necessary scale or efficiency to turn a profit (even at such a high price). However, such a car was in-line with Tesla’s vision statement where they aim “to create the most compelling car company of the 21st century by driving the world’s transition to electric vehicles.”

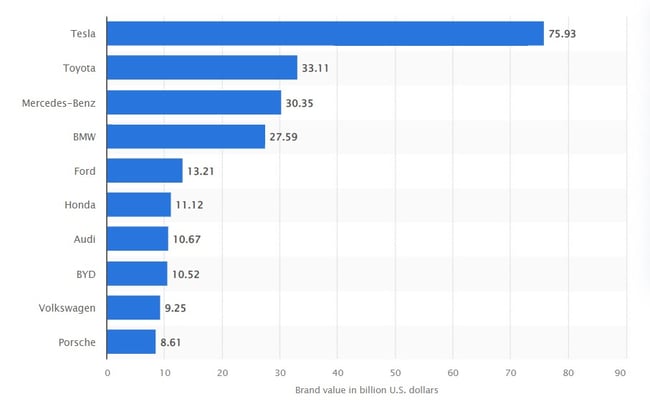

Fast-forward to today, and Tesla dwarfs the competition as the most valuable car company in the world. So their differentiation strategy certainly seems to be working, but why?

Most valuable brands within the automotive sector worldwide in 2022 – source: Statista

What can we learn from Tesla?

The first thing to note is that Tesla has made incredible progress towards its business objective of mass-produced, affordable electric cars. They’ve even made a genuine annual profit for the first time in their history.

Secondly, much of Tesla’s business strategy was actually forced upon it. There was no way they could have created a cost-effective mass-market electric car.

As a startup, they didn’t have the resources or capabilities to reap the benefits of economies of scale. Because they were creating such a unique car, they couldn’t rely on outsourcing or suppliers to gain mass-production benefits.

Fortunately, Tesla’s supply chain strategy is one of the most brilliant moves they’ve made. They knew early on that batteries would present the biggest technological hurdle to their cars and the biggest bottleneck to production.

Rather than let this derail them, they took complete control of their supply chain by investing in battery manufacturers. This has the additional benefit of simplifying diversification as Tesla can use those same batteries in parallel business ventures such as their Powerwall.

Of course, Tesla’s business strategy required vast capital and fundraising (Elon is rich but not quite rich enough to fund it all himself). That’s where the marketing genius of Tesla kicks in.

For the most part, their marketing efforts are only partially about their cars. Tesla is seen as Elon Musk’s personal brand, and that had an enormous impact on whether or not they got the investment they needed.

He’s smart, divisive, wild, and ambitious. But whatever you think about Elon Musk, you’d be hard-pressed to traverse more than a couple of consecutive news cycles without seeing him on the front page. And that’s a fantastic recipe for getting the attention of investors.

Tesla studied and adapted to the industry and business environment they would operate in. They knew their strengths, understood their market position, and built their strategy around their own findings instead of following conventional wisdom.

2. Airbnb – Forgetting all about scalability

Airbnb is one of the fastest-growing tech companies. Shortly after their IPO in December 2020, they reached a US$100B+ valuation, and the company has quite possibly changed the way we travel forever. But did you know they started out about as low-tech as you can get?

It all began with co-founders Brian and Joe renting out 3 air mattresses on their apartment’s floor. They made $80 per guest. It seemed like a great idea for a startup, so they launched a website and invited other people to list their own mattresses for hire.

They got a few bookings here and there, but things didn’t go well for the most part. So much so that in 2008, they resorted to selling cereal to make ends meet.

They had plenty of listings on the site and plenty of site traffic. Potential customers were out there, but they weren’t making enough bookings.

They identified the most likely problem – the low quality of listings that were simply not enticing. So Brian and Joe decided to take matters into their own hands.

The co-founders grabbed their cameras and visited every one of their NYC listings. They persuaded the owners to let them take a ton of photographs of their places.

They touched them up a bit and uploaded them to the website, replacing the old, usually bad photos. Within a month of starting this strategy, sales doubled. Then tripled. The rest is history.

What can we learn from Airbnb?

The thing I love the most about this story is that it opposes one of the most commonly stated principles of building a tech startup – “everything must be scalable”.

What Brian and Joe did was anything but scalable. But it got them enough traction to prove that their concept could work.

Later, they did scale their initial solution by hiring young photographers in major locations and paying them to take professional photos of owners’ listings (at no charge to the owner).

They also added a bunch of guidelines and articles on the site to educate owners on how they can make more money by taking better photos.

Airbnb’s story shows that business strategies don’t have to be grand and super long-term affairs.

They can revolve around a specific challenge preventing the business from taking off. Once the challenge is solved, the company progresses on its roadmap and integrates the solution into the revamped business strategy.

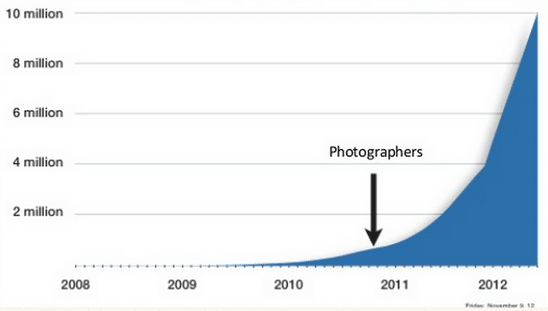

Source: Airbnb third quarter 2022 financial results

3. Toyota – Humility can be the best business strategy

In 1973, the ‘Big Three’ car makers in the USA had over 82% of the market share. Today they have less than 50%. Why? Because of the aggressive (and unexpected) entry of Japanese carmakers into the US market in the 1970s – led by Toyota.

Cars are big, heavy, and expensive to ship around in large numbers. That’s one of the reasons the US market was caught off guard when Toyota started selling Japanese-made cars in the US at lower prices than they could match.

The car industry was a huge contributor to the US economy, so one of the first reactions from the government was the implementation of protectionist taxes on all imported cars – thus making Japanese cars as expensive as locally made cars.

But the tactic failed. Within a few years, Toyota had managed to establish production on US soil, thus eliminating the need to pay any of the hefty new import taxes. At first, US carmakers weren’t all that worried.

Surely by having to move production to the US, the costs for the Japanese carmakers would be roughly the same as those of the local car companies.

Well, that didn’t happen. Toyota continued its cost leadership strategy. It still manufactured cars for significantly less money than US companies could.

Their finely honed production processes were so efficient and lean that they could beat US carmakers at their own game. You’ve probably heard of the notion of ‘continuous improvement’. In manufacturing, Toyota is pretty much synonymous with the term.

US Car Sales Graph- January through May 2021 vs 2020

Source: GOODCARBADCAR

What can we learn from Toyota?

Most business success stories involve bold moves and daring ideas. But not this one.

Toyota spent years studying the production lines of American carmakers such as Ford. They knew that the US car industry was more advanced and efficient than the Japanese industry. So they decided to be patient.

They studied their competitors and tried to copy what the Americans did so well. They blended these processes with their strengths and came up with something even better.

Toyota proved that knowing one’s weaknesses can be the key to success – and be one of the best business strategies you can ever deploy.

Not just that. Can you name a single famous executive at Toyota? I can’t. And one of the reasons is that Toyota’s number one corporate value is humility. It helped them crack the US market, and it runs deep in the organization – from top management to assembly workers.

Toyota’s success is based on continuously improving its functional level strategy, which focuses on day-to-day operations, decisions, and goals. They understood that the bigger picture consists of thousands of small tasks and employees.

They took a big goal, such as “becoming a cost leader in our category without compromising quality”, and ensured that their mission impacted every level of the organization while staying true to their core values.

4. HubSpot – Creating an industry then dominating it

HubSpot might not be as famous as Airbnb or Toyota. However, being valued at $22.72 billion in 2022 means, they’re certainly no slouch.

And most impressively, they’ve become such a successful company in an industry that didn’t even exist before they invented it.

Most of the marketing we experience is known as ‘interruption’ marketing. This is where adverts are pushed out to you whether you like it or not. Think tv adverts, billboards, Google Adwords, etc.

In 2004, HubSpot created a software platform that aimed to turn this marketing concept on its head. The HubSpot marketing platform helped companies write blog posts, create eBooks, and share their content on social media.

The theory was that if you could produce enough good quality content to pull people to your website, then enough of them might stick around to take a look at the product you’re actually selling. Useful content created specifically for your target market should also increase customer retention.

This approach was a big deal. I can tell you from personal experience that ‘interruption marketing’ is really expensive. We pay Google around $10 each time someone clicks on one of our AdWords adverts. Remember, that’s $10 per click, not per sale. It adds up pretty fast.

On the other hand, this blog receives more than one million clicks per year. Each article keeps generating clicks at no additional costs once it’s written and published.

Inbound marketing basically saved our business – so it’s fair to say that this example is pretty close to my heart!

Hubspot coined the term ‘inbound marketing’ – and long story short, they’re now one of the biggest SaaS companies in the world. But that’s not the interesting part of the story.

What can we learn from HubSpot?

Hubspot’s successful business strategy is based on a new type of marketing. Now here’s the twist that separates it from generic strategies: Hubspot used their new marketing approach to market their own company, whose sole purpose was to sell a platform that created that new type of marketing. Head hurting yet? Mine too.

Most companies would have taken that new approach and applied it to something they were already selling. But instead, the HubSpot guys decided to monetize the marketing strategy itself.

They took a whole bunch of concepts that already existed (blogging, eBooks, etc.) and packaged them into an innovative product – ‘a new way of doing things’.

They created an awesome narrative and proved how powerful their new way of marketing could be by building a business worth billions around it.

Their best and biggest case study was their own product, and they had all the numbers and little details to showcase to the world it really works.

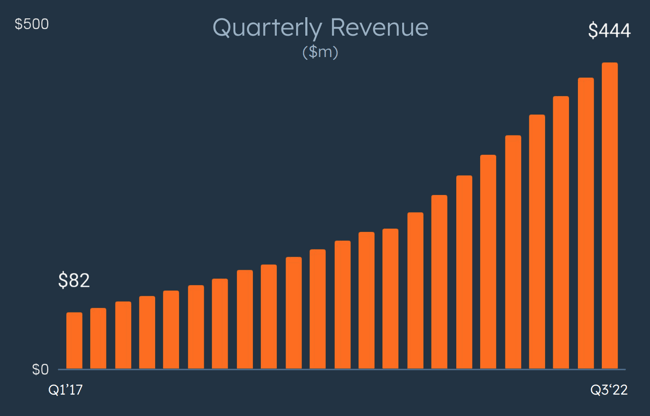

Source: Hubspot overview

5. Apple – iPhone launch shows tremendous restraint

Ok, I hear you – this is such an obvious inclusion for the ‘best business strategies’. But as one of the first people to adopt smartphones when they came out in the 1990s, this is something else that’s close to my heart.

I remember using Windows Mobile (the original version) on a touchscreen phone with a stylus – and it was horrible. I loved the fact that I had access to my email and my calendar on my phone.

But I hated that my phone was the size of a house and required you to press the screen with ox-like strength before any kind of input would register.

Thankfully, a few years later, BlackBerry came along and started to release phones that were not only smart but much more usable. Sony Ericsson, Nokia, HTC, and a whole host of other manufacturers came out with reasonably solid smartphones well before 2007 when Apple finally released the iPhone.

I remember arriving at the office one day, and my boss had somehow gotten his hands on one of the first iPhones to be sold in the UK. I was shocked. Normally I was the early adopter. I was the one showing people what the future looked like.

And yet, here was this guy in his mid 50’s, with his thick glasses, showing off a bit of technology that I’d never even seen before.

Apple could easily have created a phone much earlier than it did and sold it to me and a few other early adopters.

But it didn’t. Instead, it waited until the technology was mature enough to sell it to my boss – someone who is far less tech-savvy than me. But also far more financially equipped to spend plenty of money on new tech products.

What can we learn from Apple?

The big learning here is that first-mover advantage is often not an advantage. A well-executed ‘follower’ strategy will outperform a less well-executed ‘first mover’ strategy every single time.

One of the most common misconceptions in the startup world is that it’s the ‘idea’ that matters the most. The truth is, the world’s most successful companies were rarely the original innovators. I’m looking at you, Nokia. At you, Kodak. And at you as well, Yahoo.

In fact, being first is probably a disadvantage more often than it’s an advantage. Why?

- Your market isn’t well defined and doesn’t even know your product type exists.

- If you have a market, it’s probably just the early adopters – by definition, that’s a niche market.

- Technology will often hold you back rather than power you to success.

- Every business that comes after you will have the advantage of learning from your mistakes.

People, and especially tech companies, get carried away with being first and forget that it’s a competitive position with pros and cons. Deciding to be a ‘first mover’ or ‘smart follower’ is crucial for strategic planning.

It’s a decision that should be based on research such as swot analysis and not on pride or blind optimism as it can make all the difference between success and failure.

6. PayPal – Daring to challenge the status quo

There are certain industries that you just don’t mess with. Industries like aerospace, big supermarkets, semiconductors, and banking. Actually, banking is probably the toughest industry to try to disrupt because the barrier to entry is huge.

You need mountains of capital, a ton of regulatory approval, and years of building trust with your customers around their most important asset – cash.

Banks are old. Their business models have been essentially unchanged for hundreds of years. They’re insanely powerful and almost impossible to displace. But for some crazy reason – PayPal didn’t seem to care.

I can tell you from personal experience (I worked for a bank) that the name which strikes the most fear into the executives of the banks is PayPal.

Here’s why:

- PayPal spends less money on technology than even a medium-sized bank does. Yet its technology platform is far superior.

- Consumers trust PayPal as much if not more than they trust their bank. Even though PayPal has been around for a fraction of the time.

- When a customer uses their PayPal account, the bank has no clue what the customer bought. The transaction appears on the bank statement as merely ‘PayPal’. That gives PayPal all the power when it comes to data mining.

- PayPal is quicker to market with just about any kind of payment innovation.

- PayPal refuses to partner with banks – instead opting to partner with retailers directly.

In a very short time, PayPal has emerged as a new payment method – giving a very real alternative to your trusty debit or credit card. PayPal has also become one of the best payment platforms for digital nomads, tapping into one of the fastest-growing business trends in the world.

But how the heck did it manage to do it? Let’s take a look at why PayPal had one of the best business strategies ever.

What can we learn from PayPal?

There are two main reasons behind PayPal’s success story.

The first is simple – stone-cold balls. They got a fairly lucky break when they accidentally became the favored payment provider for eBay transactions. A few years later, Paypal was even acquired by eBay for US$1.5bn.

eBay was smart enough to mostly leave Paypal alone, and their newfound sense of boldness saw them strike a series of deals with other online retailers to try and replicate the success they’d had with eBay.

This is where the second reason comes in. Partnerships. Banks had always been wary about forming partnerships with retailers directly. Instead, they relied on their scheme partners (Visa / MasterCard) to do it for them.

They didn’t want the hassle of managing so many different relationships and were extremely confident that credit and debit cards would always be at the heart of the payment system. But the problem was that MasterCard was already working on a partnership with PayPal.

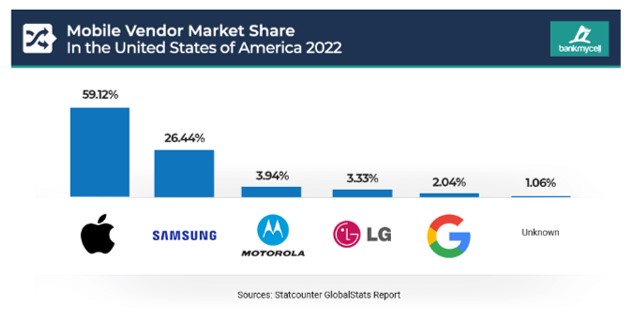

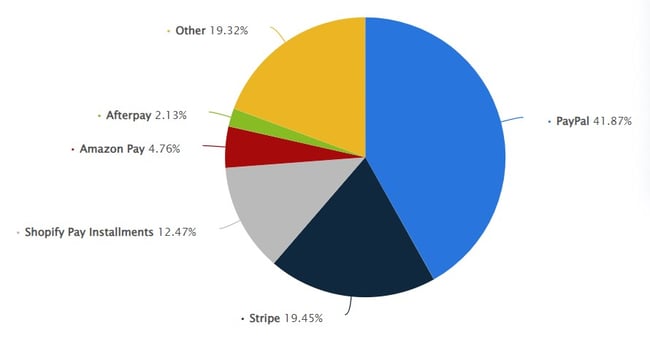

Today, PayPal commends an amazing 54% share of the payment processing market. Almost all of that growth has come from their direct relationships with large and small merchants.

It shows that even in the toughest and most competitive markets, you can still find opportunities worth exploring and uncover a key to a very good business strategy.

Market share of online payment processing software technologies worldwide Sep 2022. Source: Statista

7. Spotify – Changing the rules of the music industry

Before Spotify came along, the world of online music streaming was pretty lackluster. Sure, you had platforms like Napster and The Pirate Bay, but they were illegal and you never knew when they would get shut down. And even if you did use them, you were still pretty limited in terms of what you could listen to.

On the other hand, you had platforms like iTunes and Pandora, but they had their own set of problems. With iTunes, you had to pay for each and every song, which was a total bummer. And Pandora, you couldn’t listen to whatever song you wanted, it was more like a radio station.

Basically, people were craving for a better way to listen to music, one that was legal and gave them the freedom to choose what they wanted to listen to. And that’s where Spotify comes in.

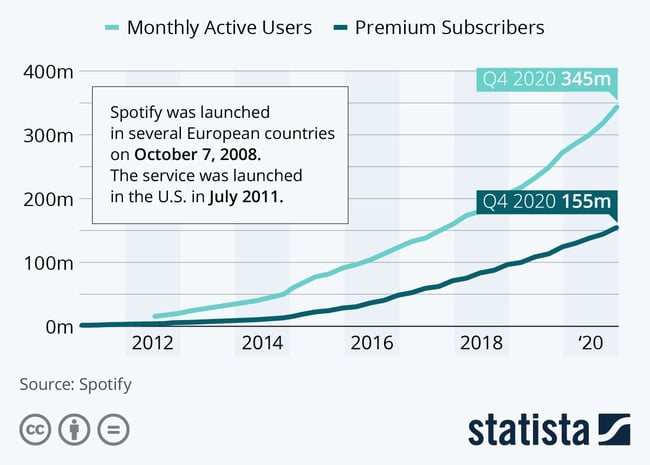

When Spotify launched in 2008, it was a game-changer. They took the best parts of platforms like Napster and The Pirate Bay (the ability to share music), but made it legal. And they also took the best parts of platforms like iTunes and Pandora (the ability to choose what you want to listen to), and made it better. As we all know, it turned out to be quite an effective business strategy.

What can we learn from Spotify?

Spotify nailed it by putting their customers at the forefront of their business strategy. They saw that people were fed up with the limitations of other music streaming platforms and decided to create a service that put the customer’s needs and wants first. They invested in technology and engineers to ensure the experience was seamless and easy for listeners, and it worked like a charm. People flocked to Spotify like bees to honey because it gave them the freedom and control over their music choices that they craved.

Another big part of Spotify’s success was (and still is) their freemium business model. They offered a free version of the service, but also had premium options for those who wanted more features and services. This allowed them to attract a huge user base and generate revenue from both the free and paying users. This model helped Spotify grow its user base and revenue quickly, more than exceeding their business goals.

And let’s not forget about their data-driven approach. They invested heavily in data analysis and machine learning, which allowed them to create algorithms to predict which songs and artists users will like and recommend them accordingly – going one step further into user personalization. This helped to drive engagement and loyalty, making Spotify the go-to platform for discovering new music and creating playlists.

Source: Cascade

16 Jul 2020

10 Aug 2019

14 Aug 2019

10 Aug 2019

16 Sep 2021

19 Sep 2021