Related diversification or integration strategy is a strategy that goes beyond existing products and markets within current capabilities and value networks of the firm. Related diversification strategy includes 2 categories:

Vertical integration includes backward integration and forward integration in the firm’s value chain. Backward integration implies the development of activities related to the firm’s inputs; for example, a firm acquires or invests in the production of its own materials. Forward integration occurs when firm develops new activities related to their outputs; for example, a firm carries out by itself the transport, distribution, repair of their existing products.

Horizontal integration consists in developing new activities that are complementary to existing ones for serving the existing customers of the firm. Adopting this strategy, firm can gain competitive advantage by using sales force and/or production technology of existing product lines in exploiting the complementary products for the existing loyal customers; for example, software firm sells computers and printers.

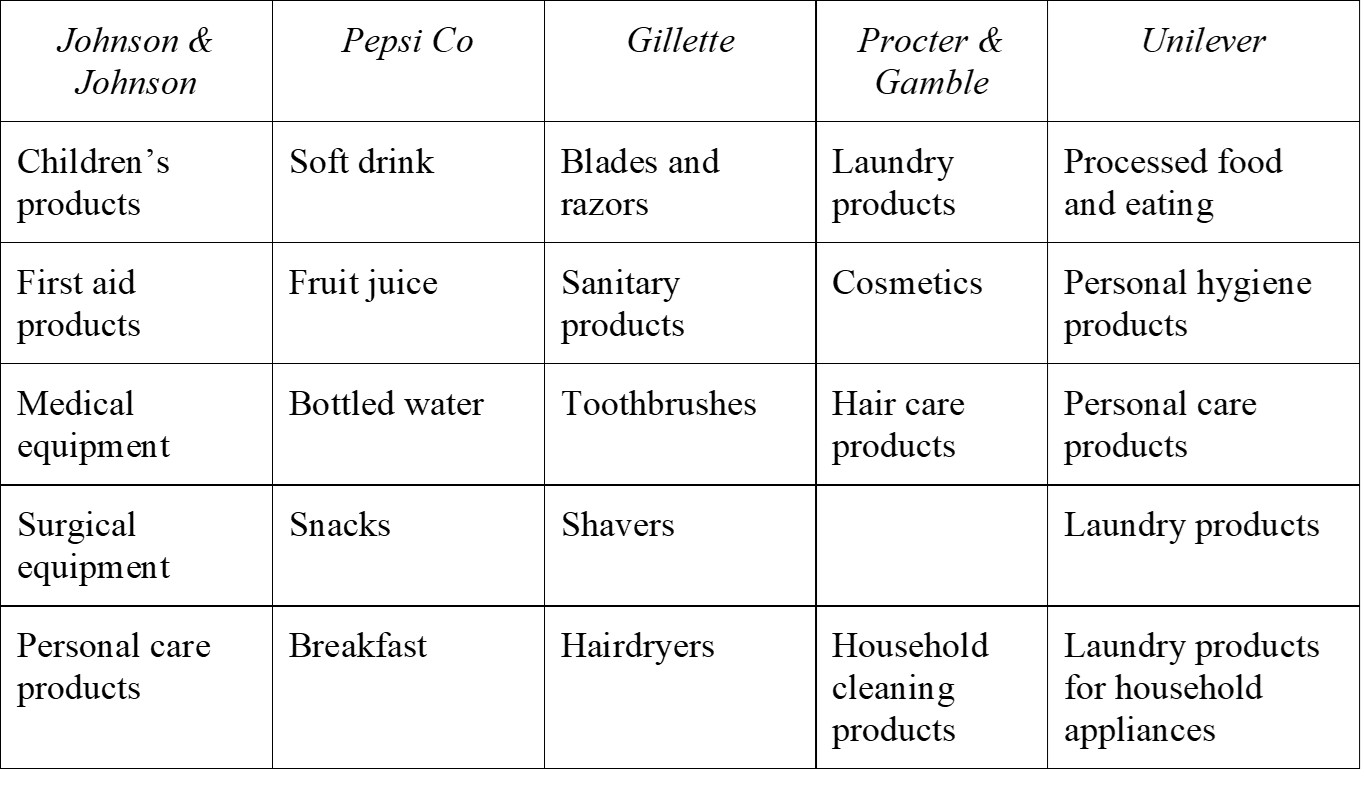

Procter & Gamble and Unilever are examples of adopting integration strategy. They are successful diversified corporations in building their global brands, although their profits result mainly from fast-moving consumer goods distributed to retailers. Their core competency consists in their good capabilities in R&D, marketing, and building strong relationships with retailers in the world.

In addition, concentric diversification can be vertical or horizontal integration strategy in which firms enter new or similar industries to existing ones by maximizing their existing marketing productivity and technology system (in three ways: sales technology-related, sales-related, and technology-related). This strategy is always used in industries having low or no growing. For example, Kinh Do Corporation firstly have launched one kind of savory cake; obtaining good sales with low competition, it developed many products of the same kind. Or, desktop computer manufacturers, face to market saturation and fast technological developments, decided to make also laptops.

Concentric diversification is also used to add new products and services related to existing products in order to increase sales of existing products. Ansoff (1957) believes that this strategy is highly profitable and less risky than other diversification ones, particularly if firm has a strong management team. For example, Surf was launched for middle and low-income customers by Unilever as its diversification strategy for enhancing the reputation of OMO – core detergent product of Unilever. Surf allows increasing profits but also balancing sale revenue face to price fluctuations.

Table 1: Some examples of related diversifications

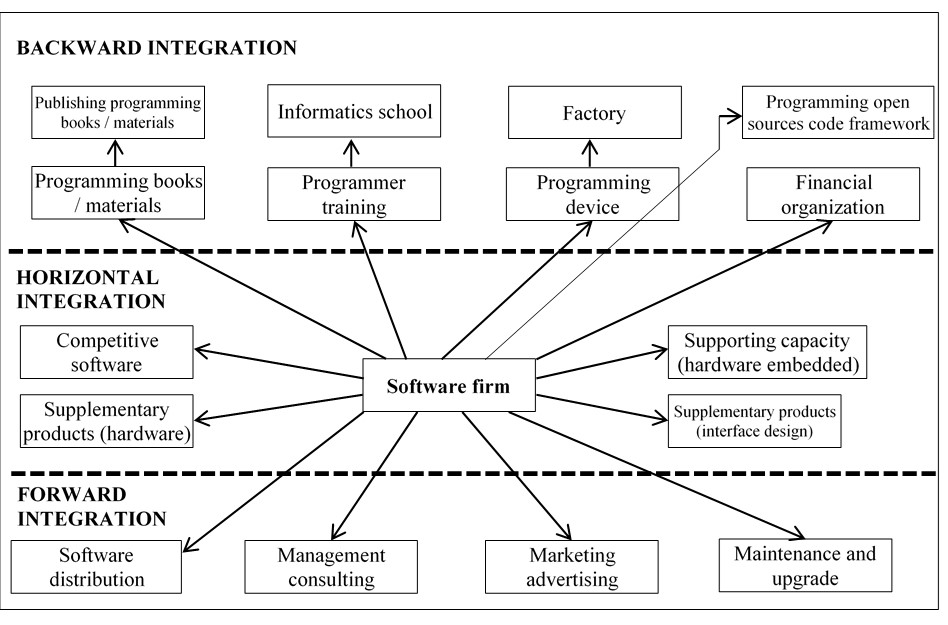

In practice, strategic managers should collect and establish, as shown in the example of a software firm, different options possible. Accordingly, this firm can integrate horizontally by developing software supplementary products such as selling hardware, printers, and computers; or developing specialized AI capabilities, or selling IT supplementary products such as website interface design, software. Also, this software firm has options of backward integration by expanding operations to suppliers; specifically, this firm can publish programming documents, train programmers, sell programming equipment, modules, programming code templates … Or, it has options of forward integration towards its intermediaries and corporate customers such as by distributing directly software; developing management consulting for customers using its management software; or online marketing based on available programming capabilities; or maintaining hardware and software products for customers. Finally, the diversification decision depends on the preferences of managers and the firm.

Figure 1: Diversification options of a software firm

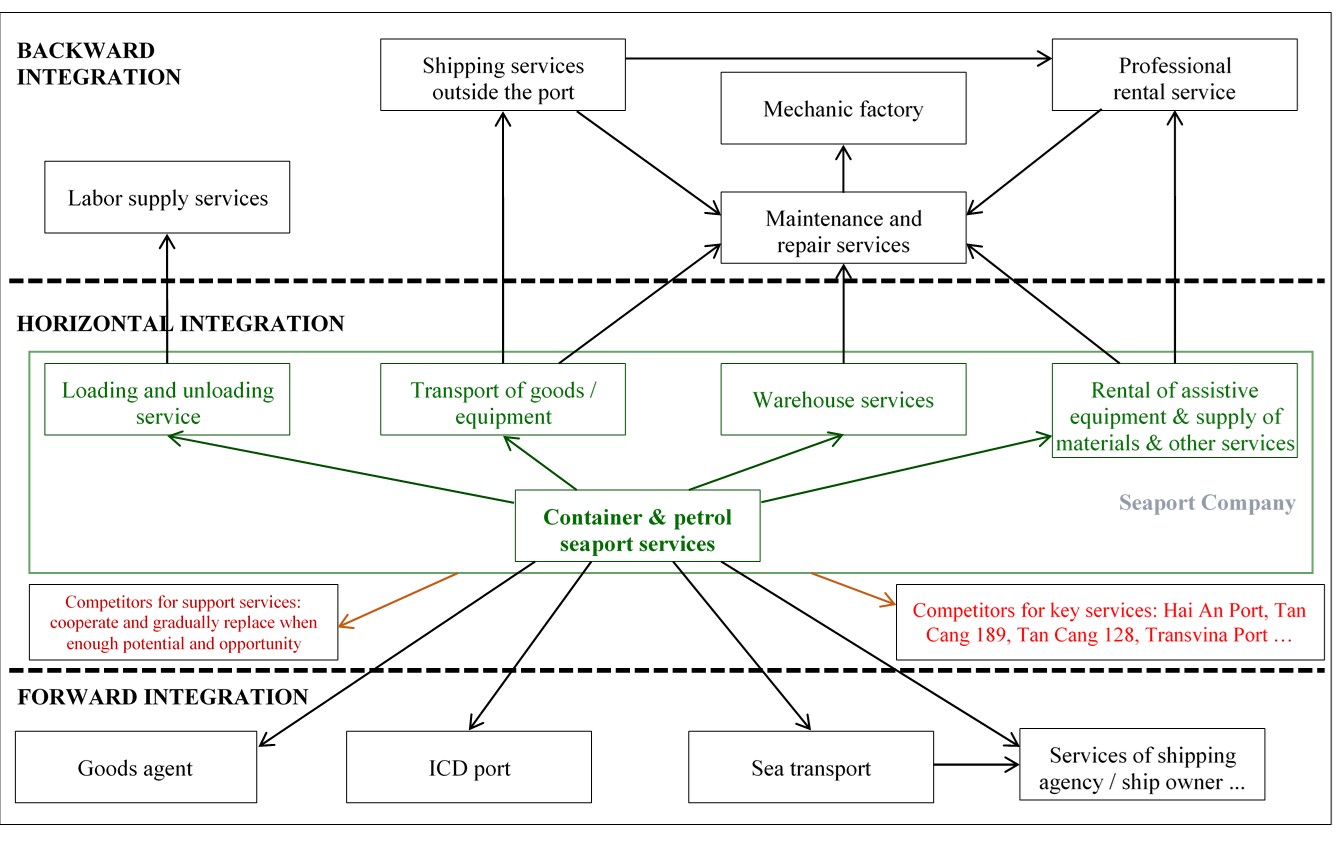

Figure 2: Diversification options of a seaport firm

15 Jul 2020

10 Sep 2019

15 Jul 2020

15 Jul 2020