If firm concentrates on its existing products – market, its strategy focuses on developing and optimizing its existing activities and resources. In contrast, taking the decision of product/ market diversification allows firms to enter new or underexplored markets and industries with new product lines by developing internal capabilities or through merger and acquisition. This leads to changes in firm’s structure, governance system, and to develop a new management process (Ramanujan and Varadarajan, 1989). This strategy was firstly mentioned by Ansoff (1957) as the ultimate diversification option in his product-market development matrix, usually called Ansoff matrix.

To differentiate industries or business areas, Wrigley (1970) proposed a method of measuring and classifying by the degree of diversification. Rumelt (1974) specifies that diversification is associated with specialization, and the criterion of distinguishing between two business industries is “the proportion of sales of certain products to the total sales of enterprises”, called the specialization ratio. In this approach, industries are actually classified by ISIC (International Standard Industrial Classification) or NAICS (North American Industry Classification System). For firm, its diversification degree is defined by two criteria: (1) the specialization rate (SR), that is the proportion of sales revenue of the largest business project (field) in the total sales revenue of firms; and (2) the correlation rate (RR), that is the proportion of sales revenue of the largest business project (field) in the total revenue of firms.

1. Definition and nature of diversification strategy

By definition, diversification strategy involves “[..] the entry of a firm or business unit into new lines of activity, either by processes of internal business development or acquisition, which entail changes in its administrative structure, systems, and other management processes” (Ramanujan và Varadarajan, 1989, p.525). In practice, firms adopt diversification strategy only when they recognize potentials or needs outside their current markets. This strategy is risky because firms must develop both new markets and new products at the same time. The risk that firms can face is that their new brand can make obsolete the original brand, or manipulate the original brand. Or sometimes, the lack of knowledge about consumers’ needs and habits makes this strategy fail.

There are three main reasons explaining why a firm should diversify its products or markets. Firstly, a firm can achieve better performance according to the principle of economies of scope, by using its existing resources and capacities in new markets and new products/services. This effect is associated with the benefits of synergy achieved when the activities and processes complement each other by resulting higher value than the sum of stand-alone activities and processes (Campbell and Luchs, 1992).

Secondly, a firm can achieve better performance when applying corporate managerial capabilities in new markets and new products/services. Existing skills developed allow the firm to manage a new set of products and services without need of additional resources. These skills are described by Prahalad and Bettis (1986) as dominant general management logic or dominant logic, in which corporate managers create value in other business units by using existing or similar skills.

Thirdly, the diversification with a portfolio of products / services allows the firm to increase its market power. With many products and services, the firm can offset losses and profits among their business activities in order to gain competitive advantage, to dominate market share, to put out some competitors … by obtaining exclusive position that will result high profits for firm in future.

2. Types of diversification strategies

In practice, firms can diversify in following ways:.

- Related diversification or Integration strategy

- Unrelated diversification or conglomerate strategy

- Developing international markets

3. Sellecting diversification strategy

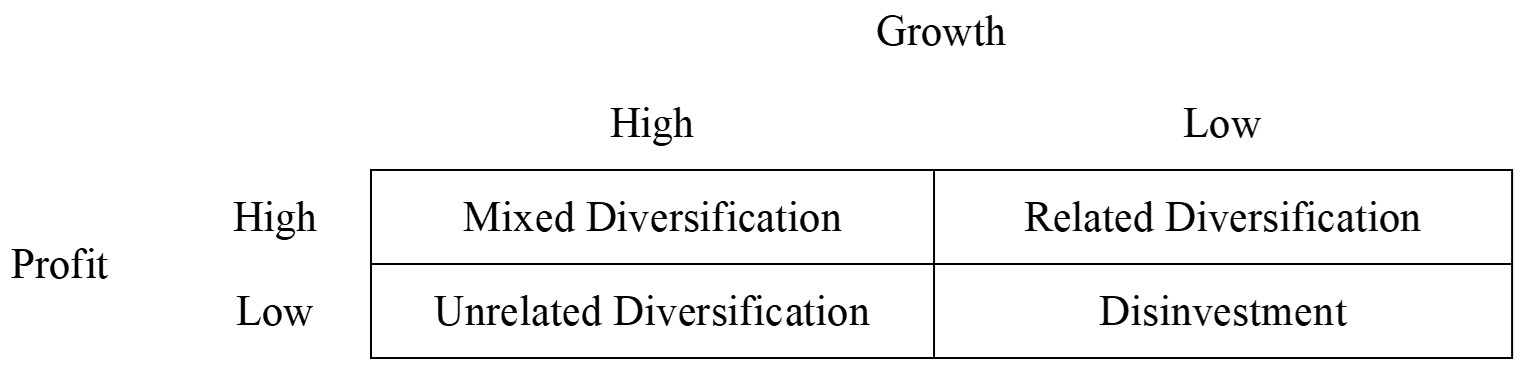

For selecting a suitable diversification strategy, firms can refer to the diversification matrix that is based by two criteria of expected growth and expected profit for establishing four frameworks of action as follows:

Figure 1: Diversification matrix

On the basis of the above diversification matrix, firms expecting high profits and accepting low growth with a low level of risk will prefer related diversification strategies. In contrast, firms that prioritize growth may employ unrelated diversification strategies by accepting low profits with a moderate level of risk. When the growth and profitability of the business fields are low, firms should consider divesting to narrow their business, often considered the most suitable solution at that time. Finally, the mixed diversification strategies, usually associated with high growth and high expected profit with high risk, are always preferred but risky for firms. Main challenges in mixed diversification strategies consist in at what mix level and how to organize mixed diversification, uncertainty concerning limited resources and managerial capacities of firms.

15 Jul 2020

15 Jul 2020

15 Jul 2020

15 Jul 2020